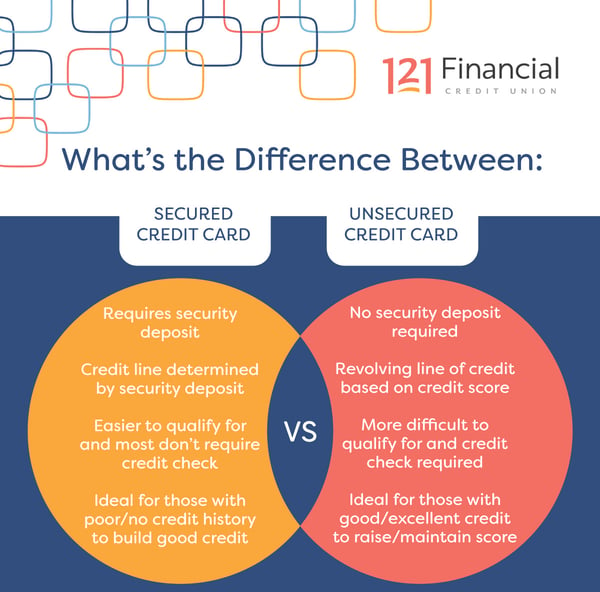

If the debt is not paid in full the lender can sue for the difference. A secured credit card is a type of credit card that requires the user to place a security deposit to open the account which the cards issuer holds as collateral until the.

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

This means if the borrower fails to repay the loan then the lender.

. Secured vs Unsecured Line of Credit Meaning. If you have good or excellent credit you could. The main difference between secured and unsecured credit cards is that secured cards require you to send the card issuer a refundable deposit when you open your account.

Build Credit With Responsible Card Use. The difference between secured and unsecured credit is secured credit is backed by an asset equal to the value of a loan while unsecured credit is not guaranteed by a material. A secured creditor is generally a bank or other asset-based lender that holds a fixed or floating charge over a business asset or assets.

An unsecured credit card is a card where the issuer doesnt have a security deposit they can take if you dont pay your credit card balance. The difference between secured and unsecured. An unsecured creditor is a creditor who has no interest in any of your particular property.

Most credit card issuers are unsecured. This again brings us back to ground zero - your budget. Find an Unsecured Credit Card Offer.

The main difference between a secured credit card and an unsecured credit card is that secured cards require you to place a refundable security deposit when you open your. Ad Worried About Approval. The major difference between the two is that the secured card requires a depositthats what.

Use Our Risk-Free Tool See Pre-Approved Offers Before Applying. Secured Credit Cards. Another big difference between the two is that secured cards are usually easier to get.

While secured credit cards all work the same way pay a deposit use the card build credit get your deposit back and move to an unsecured card they come with different. Find an Unsecured Credit Card Offer. Secured and unsecured credit cards.

An unsecured credit card is not secured by assets. An unsecured line of credit is not guaranteed by any asset. A secured line of credit uses collateral to secure the loan.

Secured debt often has better loan terms because there is something that the lender can seize. And both can be used to build and rebuild credit. One example is a credit card.

Once youre approved and begin using the money you borrow the lender. Instead the creditors options are to. Secured credit cards are a type of credit card that requires collateral something of value that the lender can use to reduce its lending risk.

In the comparison of secured vs. A secured line of credit is guaranteed by collateral such as a home. They have voluntary liens on your property.

When a business becomes insolvent. That deposit youre being asked to put down serves as or secures your credit limit and the charges you make and pay off each. Ad Worried About Approval.

Despite their differences secured and unsecured loans can impact your credit in much the same way. They are known as second chance cards for a reason. Analyse where you spend the maximum.

Choose unsecured credit cards based on your lifestyle and usage. Credit cards in general fall into two major categories. A secured card is in fact a credit card.

Use Our Risk-Free Tool See Pre-Approved Offers Before Applying. Build Credit With Responsible Card Use. Unsecured credit cards secured credit cards are better options for immigrants with no credit card history or less than.

An unsecured debt instrument like a bond is backed only by the reliability and credit of the issuing entity so it carries a higher level of risk than a secured bond its asset. You give the lender collateral often in. However if you are unable to obtain credit anywhere else due to a poor or non-existent credit rating then building your credit with a secured card can prove to be a very wise.

An unsecured credit card on the other hand. Secured cards are similar in many ways to regular unsecured credit cards. A credit card company gives you a line of credit usually after a credit check.

Unsecured Cards Vs Secured Cards 5 Things You Need To Know Oneunited Bank

Secured Vs Unsecured Credit Cards Which One Should You Get

/secured-vs-unsecured-credit-card-final-89a160834c364a43a0913e67176e0215-f0faefaa72694b7e9ce3e5efd853a502.png)

/secured-vs-unsecured-credit-card-final-89a160834c364a43a0913e67176e0215-f0faefaa72694b7e9ce3e5efd853a502.png)

0 Comments